Kate Faulkner reviews the latest property market data, which shows a slight slow down in activity, but positive forecasts for the new year.

18th Dec 20250 154 4 minutes read Kate Faulkner OBE On the ground, the property market has stalled a little, but that is a generalisation. Rightmove data shows homes over £500,000 – especially £2 million-plus – are under pressure, with sales agreed down 13% year-on-year and 8% respectively. Properties below £500,000 have not been hit to the same extent.

On the ground, the property market has stalled a little, but that is a generalisation. Rightmove data shows homes over £500,000 – especially £2 million-plus – are under pressure, with sales agreed down 13% year-on-year and 8% respectively. Properties below £500,000 have not been hit to the same extent.

Property sales are still up ‘versus the same period’ in 2024 by 4% though.

What we need to get the property market going again is a bit more certainty, so the news from the budget means that the market can now get back to a level of normality.

This includes enough stability in the economy to secure some financial headroom, lower ‘mansion tax’ than expected, with £2mn+ homes having an annual charge of £2,500 to £7,500 imposed from 2028 and an increase in income tax of 2% for rental income from 2027.

Budget forecasts suggest inflation could fall by 0.4%. With the most recent vote to hold Bank Base Rate at 4% split 5–4, and inflation edging down last month, there is hope of another cut soon.

If this happens, it should support a stronger, more active property market in 2026.

Insights from the property market indicesThe reality is when the property market has a few jitters, those that need to move will get on it with, while those that would like to move, but have some flexibility, are likely to wait until 2026.

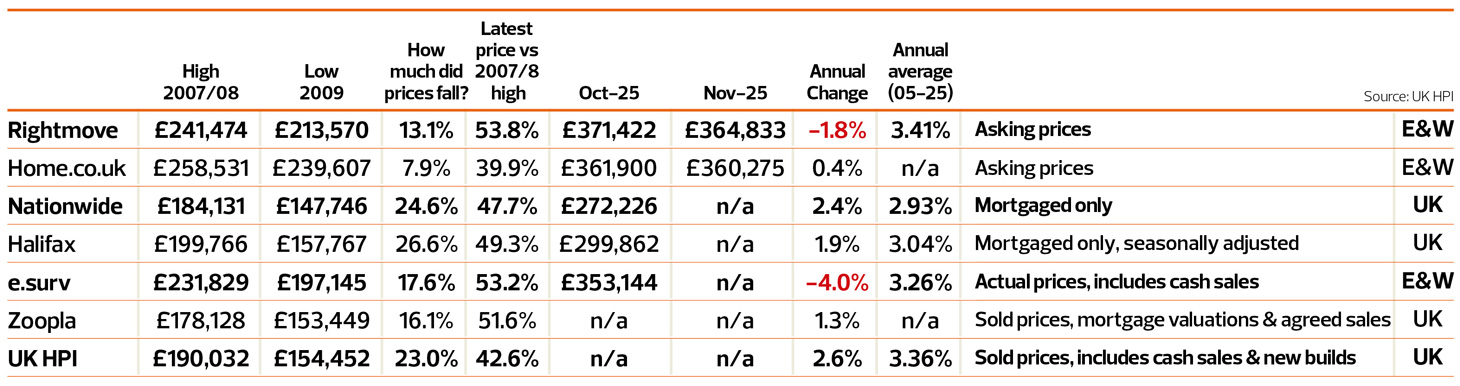

Because the slowdown shows up first in indices that track asking prices and only later in those based on completion prices, and because they can focus on different price brackets, the latest index headlines look mixed.

They range from Zoopla reporting “the first annual drop in sales agreed in two years” to Nationwide saying “Annual house price growth edges higher in October”.

Rightmove

Average new seller asking prices fall by 1.8% (-£6,589) this month to £364,833.

– This is a larger-than-usual November drop, as the decade-high number of homes for sale and Budget hiatus add to the seasonal slowdown in new seller pricing. – Asking price reductions of homes already on the market are at their highest level since February 2024, as sellers try to tempt bargain-hunting buyers. – Speculation about the contents of the Budget is fuelling uncertainty across much of the market, especially at the upper end where there are ongoing rumours of potentially costly property tax increases. – Sales agreed for £2 million+ homes, which are the subject of a potential mansion tax, are down 13% year-on-year. – Homes priced between £500,000 and £2 million, which would be impacted by potential stamp duty changes in England, or perhaps the rumoured capital gains tax, have seen sales agreed drop by 8% year-on-year. – The under £500,000 market has been less impacted, with sales agreed down by only 4% on this time last year. This mass-market sector is likely being unsettled by general Budget jitters rather than specific policy rumours.

However, more positively, Rightmove report: “Despite these downward trends across the month of October – which compares to a strong month at this time last year – the year to date still shows the number of sales being agreed at 4% above the same period in 2024.”

Home

– Annualised home price growth across England and Wales continues to be outpaced by monetary inflation. We estimate that overall real growth currently stands at around -4.2%. – There remains a veritable glut of unsold stock on the market. The total portfolio count for England and Wales is at its highest November reading since 2013. – Typical Time on Market (TTM) for unsold properties is trending higher and is currently eight days more than in November last year.

Nationwide

– Against a backdrop of subdued consumer confidence and signs of weakening in the labour market, [the] performance indicates resilience, especially since mortgage rates are more than double the level they were before Covid struck and house prices are close to all time highs. – Looking forward, housing affordability is likely to improve modestly if income growth continues to outpace house price growth as we expect. Borrowing costs are also likely to moderate a little further if Bank Rate is lowered again in the coming quarters. – This should support buyer demand, especially since household balance sheets are strong – indeed, in aggregate the ratio of household debt to disposable income is at its lowest for two decades.

Halifax

– Demand from buyers has held up well coming into autumn, despite a degree of uncertainty in the market, with the number of new mortgages being approved recently hitting its highest level so far this year. – There is no doubt that affordability remains a challenge for many. Average fixed mortgage rates are currently around 4% and likely to ease down further, but with property prices at record levels, moving home can feel like a stretch. – Rising costs for everyday essentials are also squeezing disposable incomes, which affects how much people are willing or able to spend on a new property. – Even so, while there has been some volatility, the market has proven resilient over recent months, as many buyers opt for smaller deposits and longer terms to help make the numbers work. With house prices rising more slowly than incomes for almost three years now, we expect the trend of gradually improving affordability to continue.

E.surv

– The overall picture now is one of activity settling down within a narrow range that is a little stronger than a year ago but still lacking clear direction. – That said, market sentiment has been adversely dogged by uncertainty about jobs and the wider economy and in particular by nervousness about tax changes that might be imposed in November’s Budget. While the prime parts of central London and other high-value residential areas have been particularly impacted by this, the housing market in much of the country is currently in a state of unease.

Zoopla

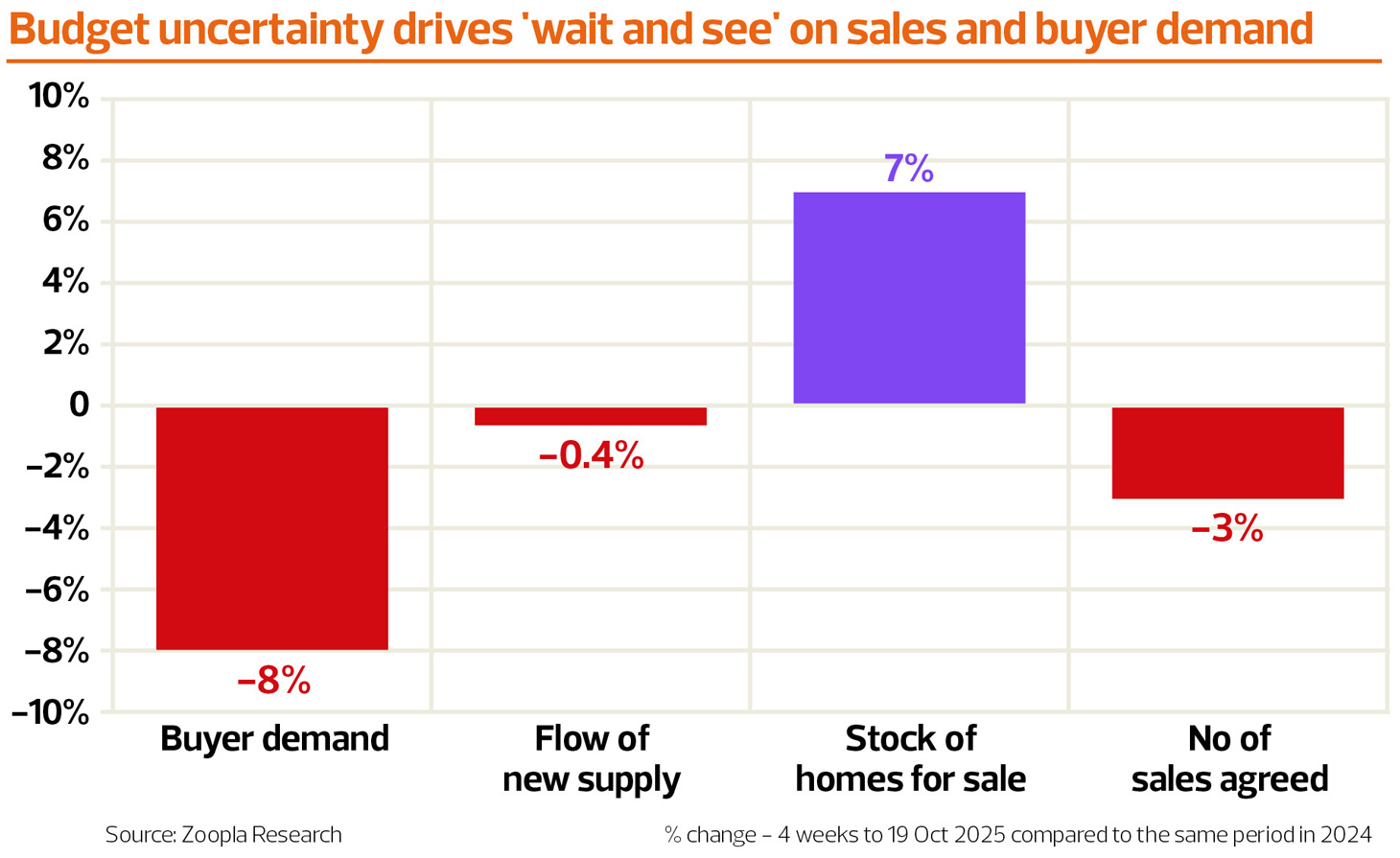

– Buyer demand is down 8% compared with last year, while sales agreed have fallen by 3%, with the slowdown most noticeable in higher-value areas. – More homes for sale (+7%), serious buyers now have more choice than they have seen in recent years. – The average time it takes to sell a home has increased to 37 days, around 10% longer than this time last year. – 350,000 homes worth £100bn are progressing through the sales pipeline – the largest in four years.