The Average Retirement Withdrawal Rate by Age

Clinging to "safe" income and hoarding your principal isn't protecting your wealth; it's shortchanging the retirement you earned.

The London-based agency, headed by Guy Gittins, sees its revenue rise 5% in 2025, but operating profit remains static. The post Foxtons reports revenue up but profit flat last year appeared first on T...

Clinging to "safe" income and hoarding your principal isn't protecting your wealth; it's shortchanging the retirement you earned.

Many women are consistent savers, but long-term balances don't always reflect those habits. Here's what's behind the gap — and what can help change it.

Arizona is moving to cut taxes on home sale gains, while Senators Ted Cruz and Tim Scott push for nationwide capital gains tax relief.

The Golden State won't touch your Social Security, but high rates on pensions and IRAs tell a different story. Can you afford retirement in California?

Working parents can take advantage of tax breaks and local assistance programs.

Dolly knows that life isn’t just about the "9 to 5." Discover the legendary singer’s inspiring tips for finding joy and purpose in retirement.

Stocks sink and fear rises as the conflict in the Persian Gulf escalates toward total war.

The tax landscape has changed yet again, thanks to the OBBBA and SECURE 2.0, and four developments are particularly important for anyone in or near retirement.

The most resilient income plans layer multiple sources of predictable income and growth-oriented assets to help ensure immediate cash flow and long-term flexibility.

Get fired up about your upcoming retirement by reframing this new chapter of life as a chance to redeploy your purpose, rather than retreat from it.

Different types offer different levels of potential risk. Here's how to choose wisely, from an annuities pro.

Raising a family on one paycheck may feel out of reach. But new data shows where a single income can still support a stay-at-home parent and where it is most difficult.

Six years after its finale, Star Wars: The Clone Wars remains the creative foundation for modern Star Wars, from The Mandalorian to Ahsoka.

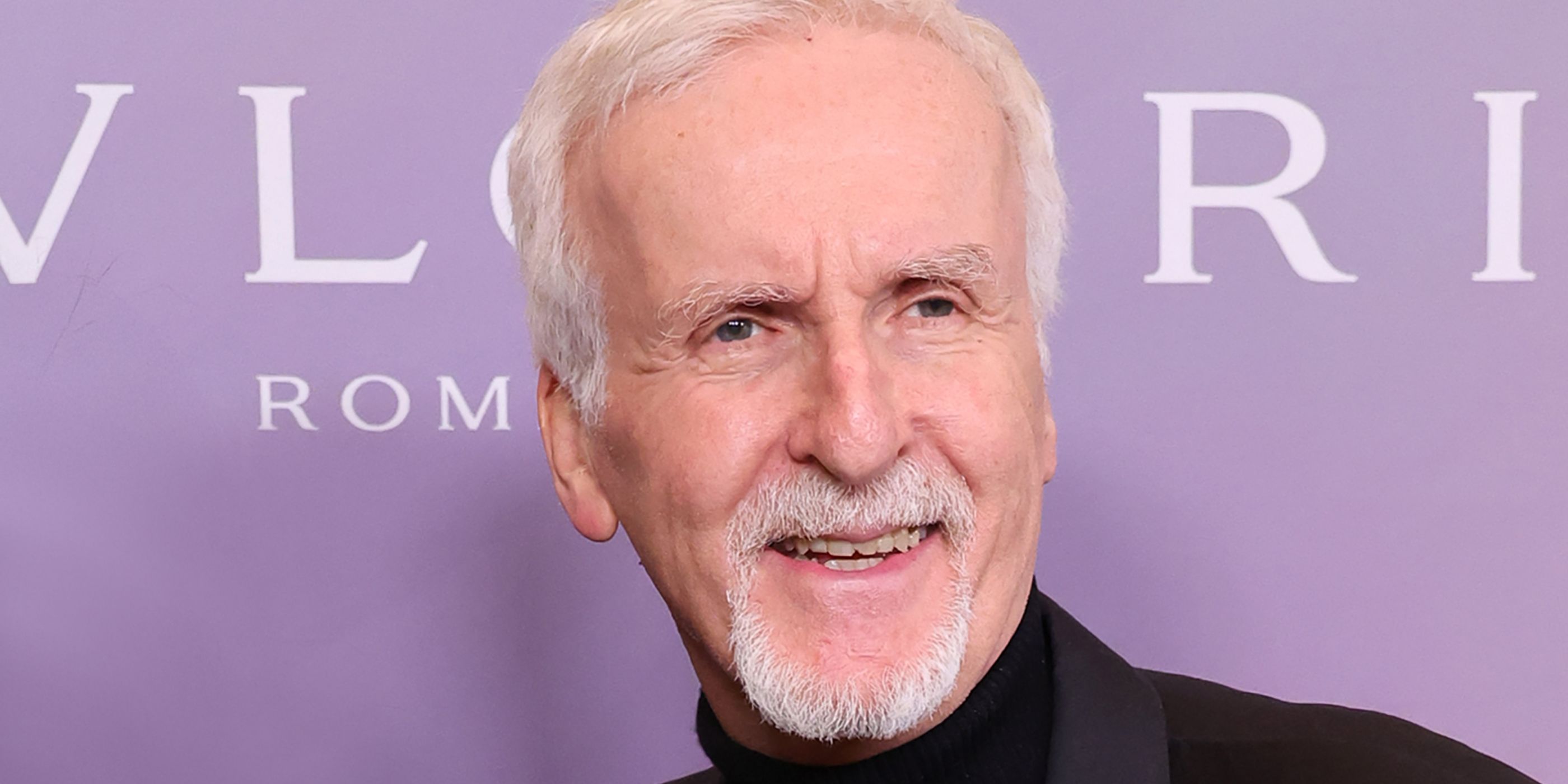

40 years later, the second sci-fi masterpiece of James Cameron's career is still scaring up fans on streaming. Find out more below.

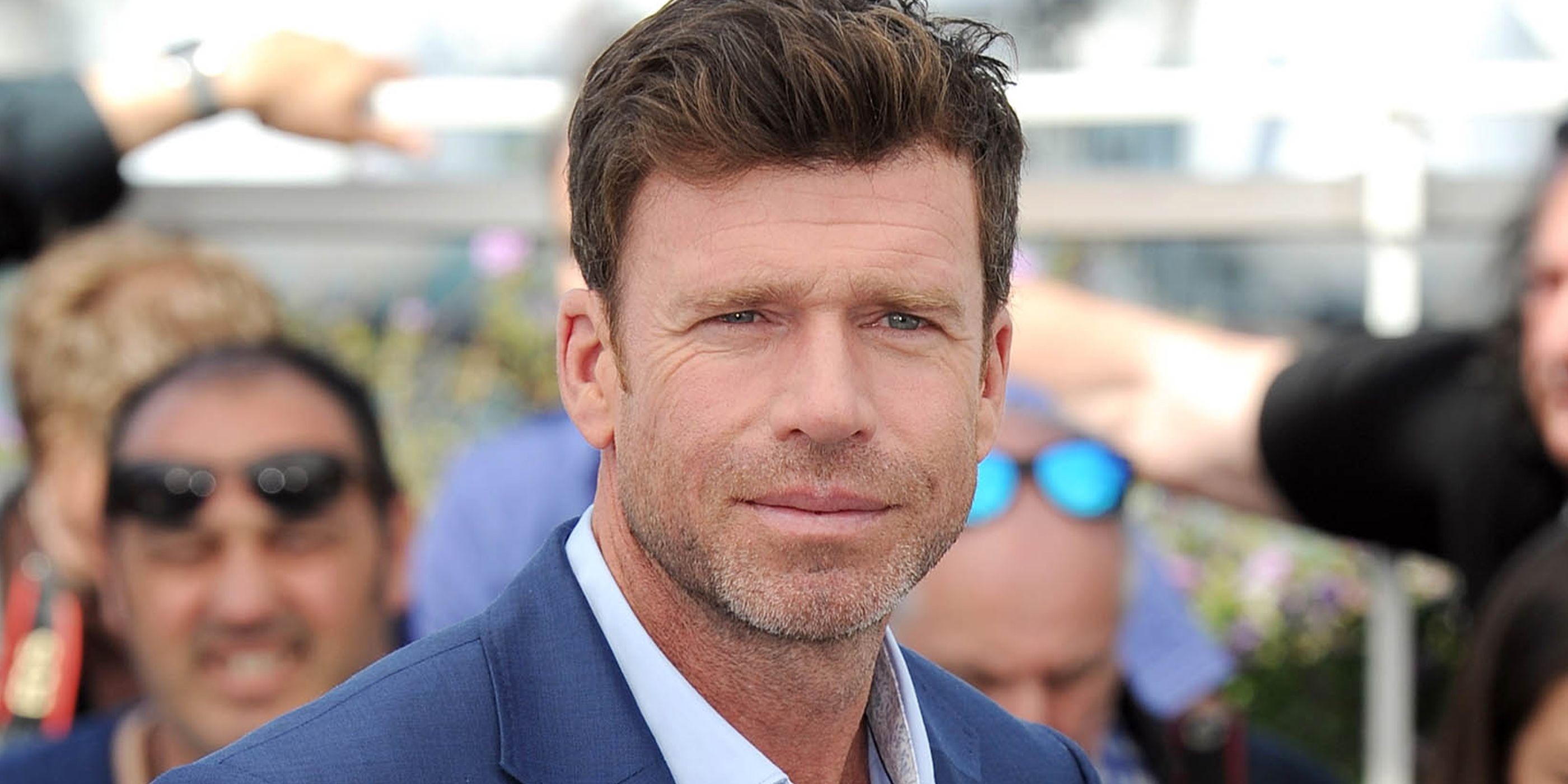

Paramount+’s current U.S. chart has Marshals at No. 5 and Landman at No. 9 among TV shows, a softer snapshot for Taylor Sheridan’s streaming empire