The Rev. Jesse Jackson’s death marks the end of an era in U.S. civil rights movement leadership, but his warnings about predatory lending remain urgently relevant, Dr. Lee Davenport writes.

Inman On Tour

Inman On Tour Nashville delivers insights, networking, and strategies for agents and leaders navigating today’s market.

Inman On Tour Nashville delivers insights, networking, and strategies for agents and leaders navigating today’s market.

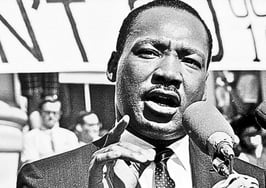

In February 2007, eight months before the stock market would begin its historic plunge and nearly a year before the word “bailout” entered every American household’s vocabulary, the Reverend Jesse Jackson stood before the Senate Committee on Banking, Housing and Urban Affairs with a warning that now reads like prophecy.

TAKE THE INMAN INTEL INDEX SURVEY

As the housing bubble burst loomed, the civil rights icon warned Congress that Wall Street’s “un-American” treatment of Black and Brown borrowers would ignite a foreclosure crisis.

The financial giants and regulators ignored him.

Notably, at the time of Jackson’s prescient words, the housing market was still standing. Home prices had not yet collapsed. But Rev. Jackson, who recently passed away after decades of civil rights leadership in pursuit of a Rainbow Coalition, saw what most on The Hill refused to see, which was that predatory lending was a contagion that would not stay contained.

“Today’s terms of credit for African American and Latino borrowers and seniors are un-American,” Jackson told the committee on Feb. 7, 2007. “The cost of money for black and brown people is not based on equal opportunity, equal access or equal protection under the law.”

His testimony, delivered at a hearing titled “Preserving the American Dream: Predatory Lending Practices and Home Foreclosures,” laid bare the statistical reality that would later become the nation’s nightmare. Jackson testified that 52 percent of mortgage loans to Black borrowers were high-rate and 40 percent of loans to Latino borrowers carried predatory terms, which we have since learned (remember The Big Short movie?) were often not due to low credit but low access to fair lending information.

Remember that the iPhone did not debut until June of that year, meaning many did not have a computer in their pocket or even at home. By contrast, only 19 percent of loans to white borrowers fell into that category. But make no mistake, that is still high, indicative of that whenever the bubble burst, it would impact record homeowners.

The disparity was not an accident. It was a business model (again, for a visual, see The Big Short).

The warning ignored

Jackson’s appearance before the Senate Banking Committee was not his first foray into fair lending advocacy. A decade earlier, he had founded the Rainbow/PUSH Wall Street Project, designed to “democratize capital in the financial services industry and remove the walls on Wall Street for people of color and women and seniors.” But by 2007, those walls had not fallen. Instead, they had been reinforced with fine print and exploding interest rates.

“The ghetto barrio established as an enclave or institution built on race, exclusion and exploitation,” Jackson testified. “It required open housing laws to relieve pressure on the overcrowding and create housing options. There remains a zone of high taxes and low services, second-class schools and first-class jails, ZIP codes that are unprotected by law. It is a fertile land for predators, financed by banks.”

Jackson’s testimony identified specific predatory practices that had flourished since the 1990s, which was steering Black and Brown borrowers into higher-priced loans than those for which they qualified, prepayment penalties that trapped families in unaffordable mortgages, yield spread premiums that gave brokers kickbacks for placing borrowers in expensive loans and low-documentation loans that required no proof of income or ability to repay (I repeat: see The Big Short movie).

The civil rights leader pointed to Chicago alone, where foreclosures for Black and Brown borrowers exceeded $598 million annually. In Boston, 70 percent of loans to middle-class borrowers (not the poor, he emphasized) were high-rate because those were more lucrative for lenders. Nevada, he noted, already had the second-highest foreclosure rate in the nation.

“The industry is not functioning properly nor fairly,” Jackson told the senators. “Lenders and brokers have financial incentives to place borrowers in more expensive loans. It puts responsible lenders at a competitive disadvantage with the irresponsible lenders, allowing unscrupulous predatory lenders to control the market.”

The players get played

The predatory lending boom of the late 1990s and early 2000s was not a collection of rogue operators working in isolation. Major financial institutions fueled the fire, and in the years following the crash, many would face prosecution.

Jackson specifically called out Fannie Mae, the government-sponsored enterprise tasked with expanding homeownership opportunities. “Current evidence reveals that Fannie Mae is purchasing securities that include the very loans that are stripping working-class people of their precious home equity,” he testified. “In purchasing such securities and profiting from predatory loans, Fannie Mae is violating its public mission and the ability-to-repay standard.”

His critique proved prophetic. After the crash, Fannie Mae and Freddie Mac would require a $187 billion taxpayer bailout (the largest in American history).

The list of financial institutions that would later face prosecution for predatory lending practices reads like a who’s who of American banking. In 2007, as Jackson testified, Countrywide Financial was originating billions in subprime loans that would later implode. The company would eventually be acquired by Bank of America in a fire sale, and Bank of America would pay $16.65 billion in 2014 to settle federal charges related to Countrywide’s toxic mortgages.

Wells Fargo, another major subprime lender, would pay billions in settlements for opening unauthorized accounts and steering minority borrowers into high-cost loans. In 2012, the bank agreed to pay $175 million to settle Justice Department charges that it had discriminated against Black and Hispanic borrowers.

Citigroup would pay $7 billion in 2014 to resolve mortgage-backed securities investigations. JPMorgan Chase would pay $13 billion in 2013 for misleading investors about mortgage securities. Goldman Sachs would pay $5.06 billion in 2016 over its role in the financial crisis.

A different kind of advocate

What set Rev. Jackson apart from other critics of predatory lending was his nuanced approach to the financial ecosystem in low-income communities. He did not simply demonize all lenders or call for the elimination of alternative financial services. Instead, he sought to understand why these services existed and how they could be made to serve communities rather than exploit them.

Columbia Law Professor Ronald J. Mann experienced this complexity firsthand when Jackson invited him to appear on a TV show about payday lending. Mann, who had written about payday lending without condemning it entirely, expected to serve as a devil’s advocate who would face withering questioning from the civil rights icon.

“Nothing could be further from the truth,” Mann later wrote in a 2012 article for the Washington and Lee Law Review. “The questions he wanted to talk about were things like ‘Why won’t banks serve our communities anymore?’ and ‘Why do people hate payday lenders so much?’ and finally, ‘What do our communities need to know to use this product safely?'”

Jackson’s approach, Mann realized, was pragmatic rather than ideological. “Ultimately, Jesse Jackson hoped the show would ease the way for payday lenders to thrive in the communities about which he cares so deeply,” Mann wrote, and I’ll add in a non-predatory fashion.

This pragmatism reflected Jackson’s understanding of the vacuum created by mainstream financial institutions. As banks closed (or never opened) branches in low-income neighborhoods, check-cashers, pawnshops and payday lenders filled the gap. Jackson wanted to ensure that these alternative providers operated fairly, not that they disappeared entirely.

Rev. Jackson, beginning in 1965 at the age of 24, often stood shoulder to shoulder with the Rev. Dr. Martin Luther King, Jr., whose assassination was credited by President Lyndon Johnson as the catalyst for the Fair Housing Act of 1968, which passed after years of filibusters and protests.

Rightly so, Jackson spoke from his lived experience and life’s work when he testified: “The American creed promises equal opportunity, equal access, equal protection under the law and a fair share for all. Forty years after the passage of the Civil Rights Act of 1964 and the Voting Rights Act of 1965, we must level the playing field for all citizens, identify incentives for our financial institutions to invest, not exploit and oppress, hard-working Americans.”

Over the following two years, more than 5 million U.S. homeowners (a staggering 1 in every 10 with a mortgage at the time) received a foreclosure notice.

In the aftermath of the crash, some reforms were enacted. The Dodd-Frank Wall Street Reform and Consumer Protection Act created the Consumer Financial Protection Bureau, which Jackson had long advocated. The CFPB (which has been on the federal funding chopping block over the last year) would eventually implement rules requiring lenders to verify borrowers’ ability to repay and banning some of the worst predatory practices.

The Rev. Jesse Jackson’s death marks the end of an era in U.S. civil rights movement leadership. But his warnings about predatory lending remain urgently relevant. Today, we are not immune to the patterns he identified in 2007 (racial disparities in lending, the targeting of communities of color for expensive credit, the failure of regulators to enforce existing laws).

Aptly, Jackson told the Senate committee in 2007, “We must greenline the redline zones and ZIP coded zones and use Government-private partnerships to break this pattern. We must see the underserved markets as an opportunity for growth and development rather than exploitation and unscrupulous profiteering.”

Rev. Jackson, you were a prophet with a microphone. Thank you for using it to warn us. Rest well.

One of my favorite childhood memories of Sesame Street is this video with Rev. Jesse Jackson.

Dr. Lee Davenport is an MBA professor and executive business coach. Follow her on YouTube and Instagram, or visit her website.

Topics: fair housing Show Comments Hide Comments Sign up for Inman’s Morning Headlines What you need to know to start your day with all the latest industry developments Sign me up By submitting your email address, you agree to receive marketing emails from Inman. Success! Thank you for subscribing to Morning Headlines. Read Next Real (Estate) Talk: Can a 50-year mortgage offer any benefits?

Real (Estate) Talk: Can a 50-year mortgage offer any benefits?

Here's the fastest way to reach new real estate clients without breaking fair housing laws

Here's the fastest way to reach new real estate clients without breaking fair housing laws

'Where do we go from here?' 6 actions real estate agents can take to keep MLK's dream alive in 2026

'Where do we go from here?' 6 actions real estate agents can take to keep MLK's dream alive in 2026

How Bad Bunny's 'DtMF' spotlights fair housing and Black history

More in Agent

How Bad Bunny's 'DtMF' spotlights fair housing and Black history

More in Agent

Compass rewards listing agents with new lead and referral program

Compass rewards listing agents with new lead and referral program

Compass CEO Robert Reffkin: No agent 'should get fined by their MLS' (VIDEO)

Compass CEO Robert Reffkin: No agent 'should get fined by their MLS' (VIDEO)

What Guinness can teach you about building a brand that lasts

What Guinness can teach you about building a brand that lasts

How to sharpen your negotiation skills without pricey seminars

How to sharpen your negotiation skills without pricey seminars

Read next

Read Next

Here's the fastest way to reach new real estate clients without breaking fair housing laws

Here's the fastest way to reach new real estate clients without breaking fair housing laws

Ryan Serhant: Real estate's future is SERHANT. vs. Compass — and I'm ready to win

Ryan Serhant: Real estate's future is SERHANT. vs. Compass — and I'm ready to win

How Bad Bunny's 'DtMF' spotlights fair housing and Black history

How Bad Bunny's 'DtMF' spotlights fair housing and Black history

Sitzer, Moehrl attorneys file new lawsuit targeting mortgage firms

Sitzer, Moehrl attorneys file new lawsuit targeting mortgage firms