In her latest analysis, Kate Faulkner reports that property supply remains high, with around three-quarters of those advertised being sold in 2025.

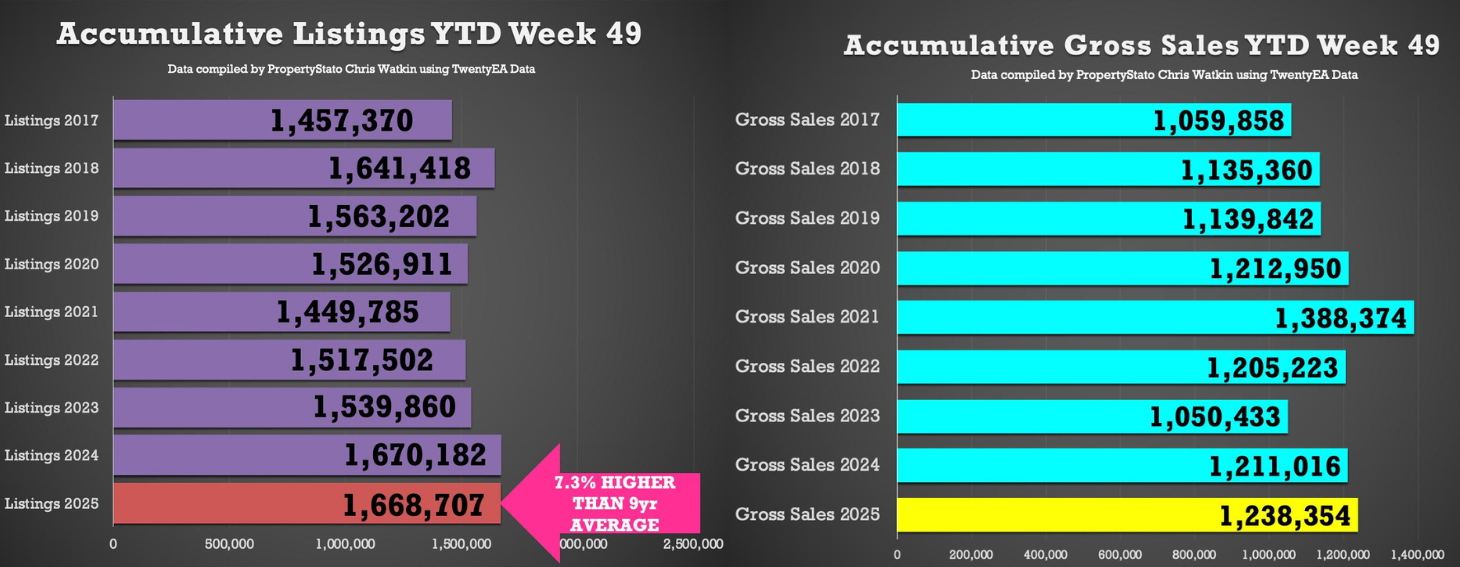

5th Feb 20260 144 2 minutes read Kate Faulkner OBE The almost final data from Chris Watkin and TwentyEA show how well the market did in terms of property supply (depending on which region you are operating in), with nearly 1.7m listings for 2025, 7% higher than the average listings since 2017.

The almost final data from Chris Watkin and TwentyEA show how well the market did in terms of property supply (depending on which region you are operating in), with nearly 1.7m listings for 2025, 7% higher than the average listings since 2017.

In contrast, gross sales were still the second-highest, and although based on a relatively crude measure, around 74% of those advertised were sold last year.

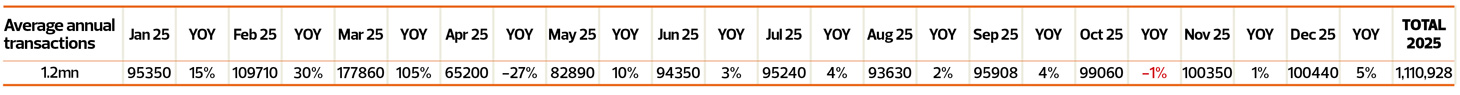

Government data shows a lower rate of transactions, with just over 1m transactions by the end of November, suggesting the final figure will be around 1.1m (December is still an estimate).

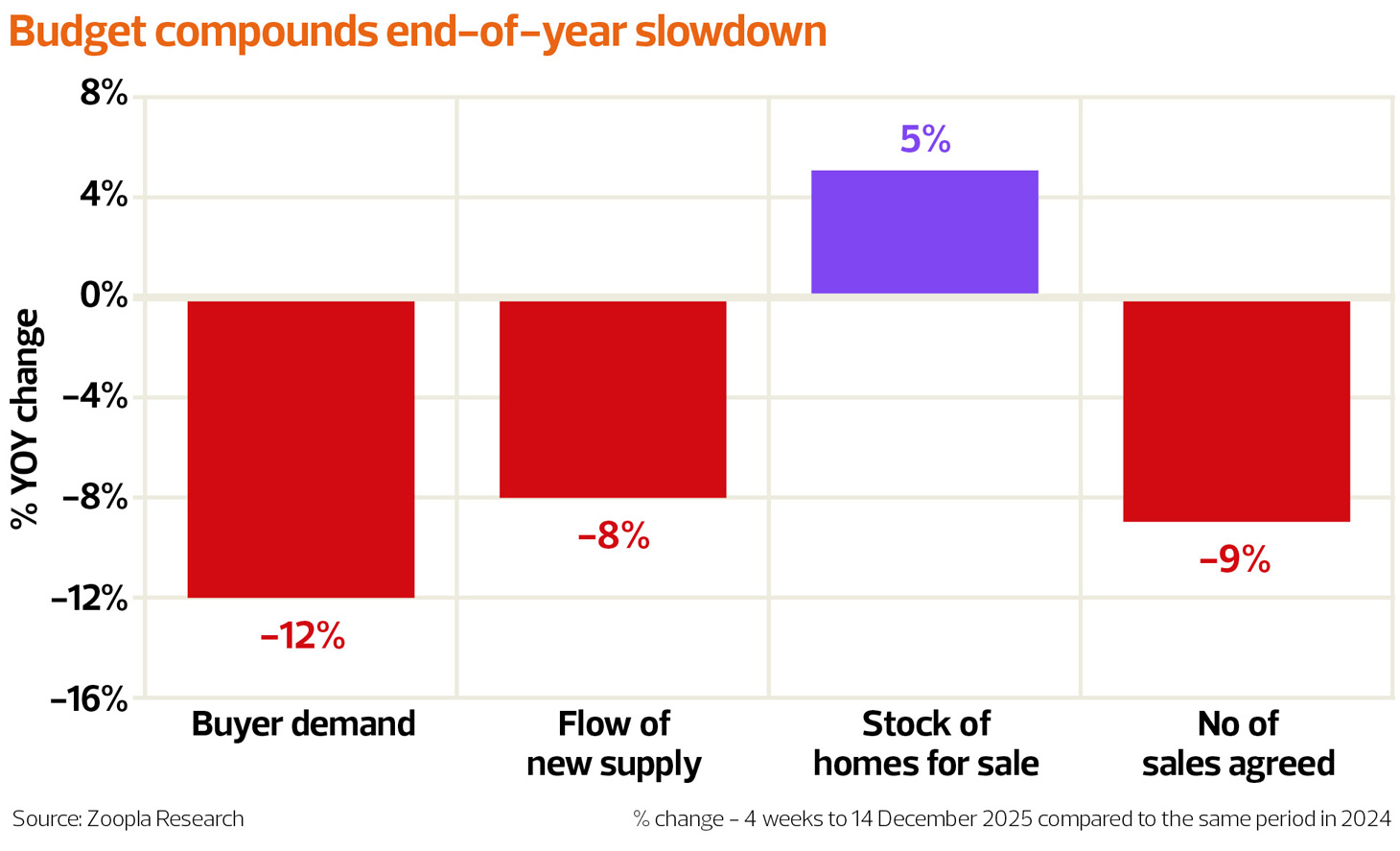

Zoopla

“Budget speculation dampened housing market activity in late 2025 beyond the usual seasonal slowdown, with Q4 recording the sharpest fall in sales agreed since 2022 as some buyers paused decisions. Recent weeks have seen demand running 12% below last year, with sales agreed down 9%.

“However, this slowdown will not affect 2025 transaction totals, as completions typically lag by around 5 months. The impact is expected to emerge in early 2026, contributing to a modest dip in sales to 1.18m.”

Propertymark

“November’s figures point to a housing market that remains resilient but measured as we head toward the end of the year. The slight dip in agreed sales reflects seasonal normalisation rather than weakening demand, whilst the steady flow of new listings shows that sellers are still confident enough to test the market.”

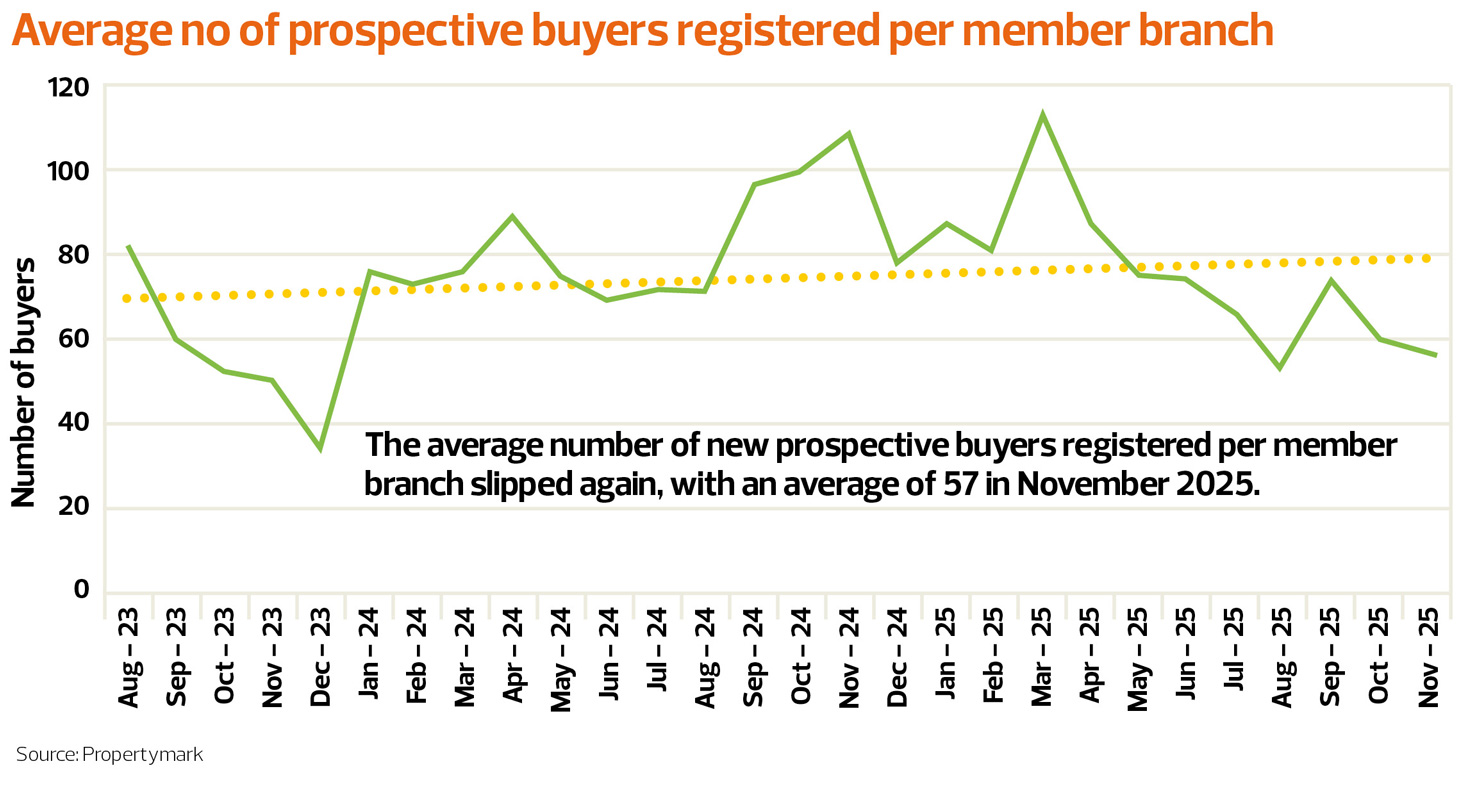

The average number of new prospective buyers registered per member branch slipped again, with 57 in November 2025.

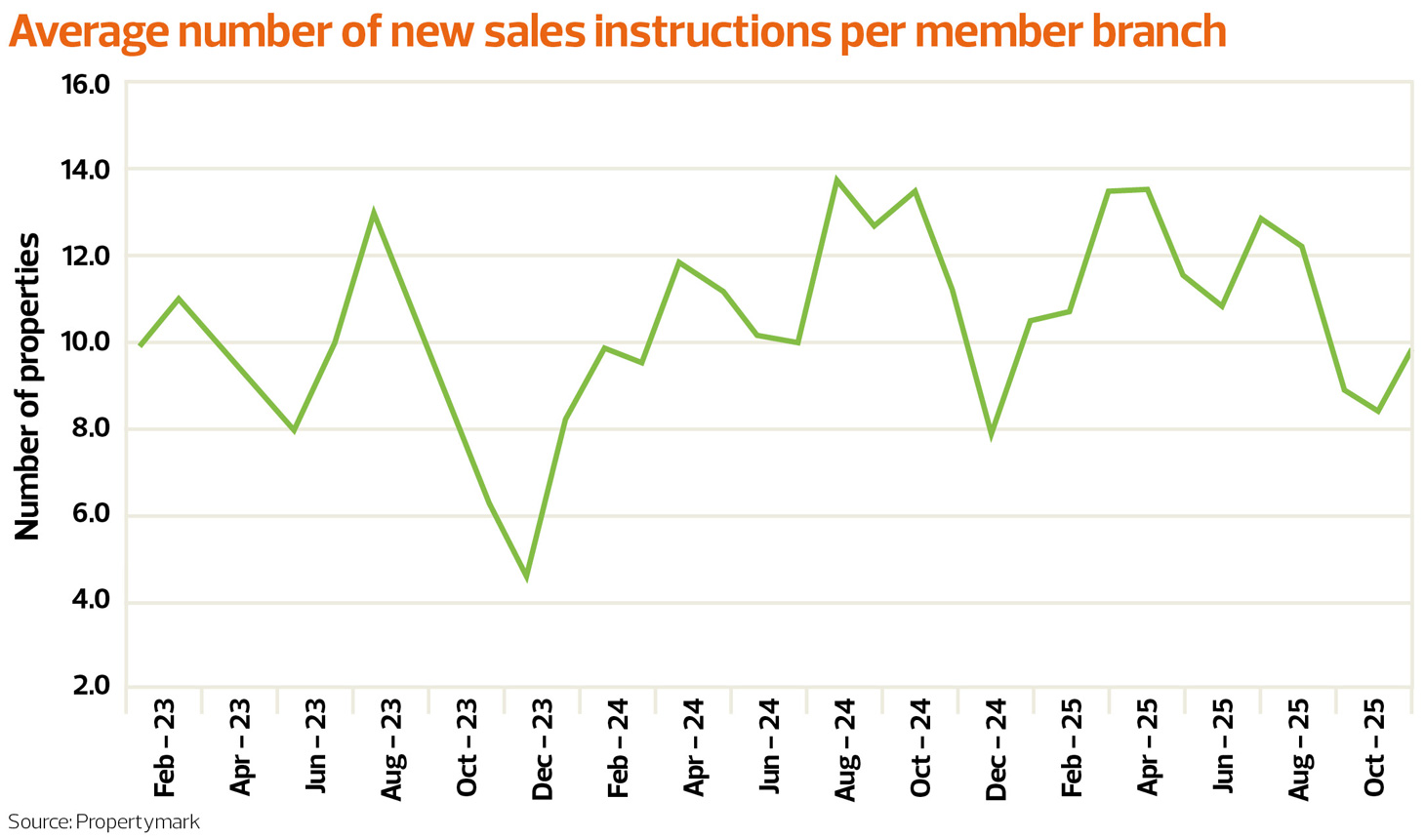

On average, per member branch, there were around 10 homes placed for sale across November 2025.

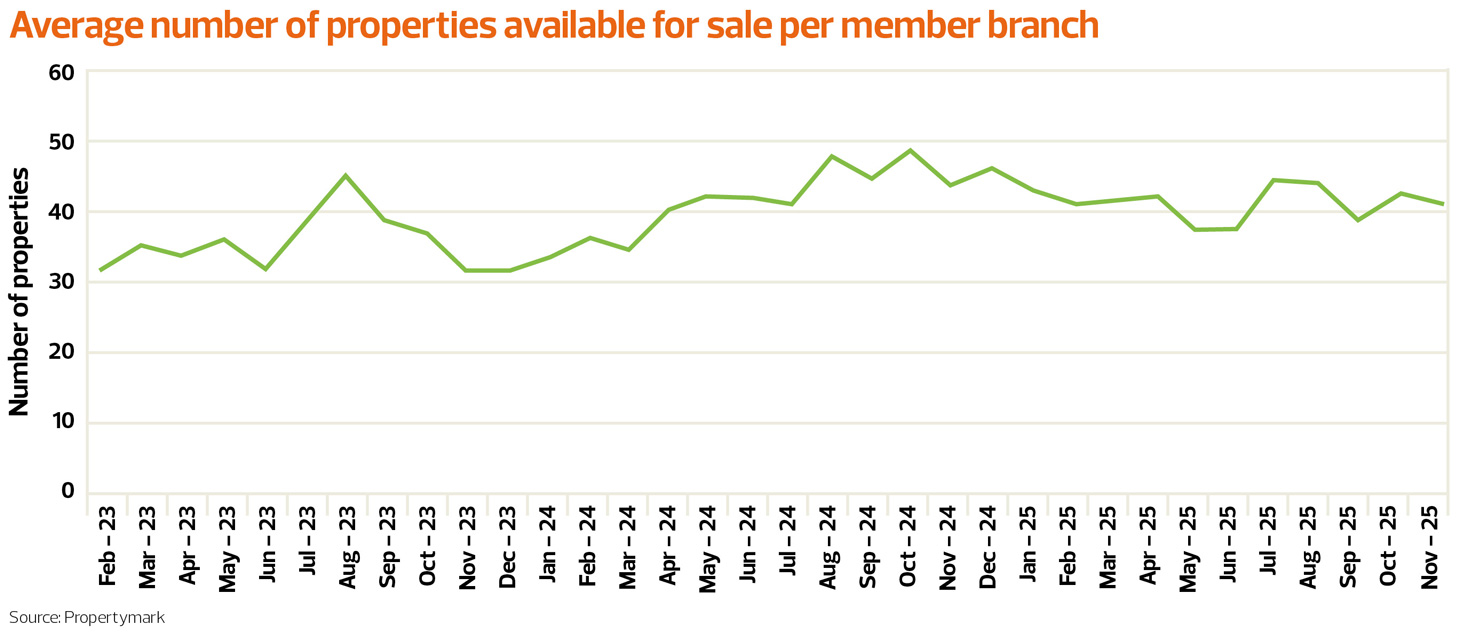

Property supply levels reflect the average number of properties available for sale at each member branch. In November 2025, stock levels declined with an overall average of 41 properties for sale at each member branch.

Rightmove

“The decade-high number of homes available on the market continues to restrict price growth, with many new sellers keen to avoid standing out by over-pricing compared with their competition.”

Halifax

“Latest Bank of England figures show the number of mortgages approved to finance house purchases decreased in November 2025 by -0.7% to 64,530. Year-on-year the figure was -2.1% below November 2024. (Source: Bank of England, seasonally-adjusted figures).

“The RICS Residential Market Survey results for November 2025 continue to show a subdued sales market. New buyer enquiries posted a negative net balance of -32%, down from -24% previously and its weakest reading since late 2023. Agreed sales at -23% is broadly unchanged from last month (-24%), while new instructions remains in negative territory for the forth consecutive month at -19% (previously -20%). (Source: Royal Institution of Chartered Surveyors (RICS) monthly report).”

Tagshouse prices Kate Falkner 5th Feb 20260 144 2 minutes read Kate Faulkner OBE Share Facebook X LinkedIn Share via Email